2022 List of Vermont Local Sales Tax Rates. 974114 15 16 24 Form S-3M ˇ ˆ SELLER.

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

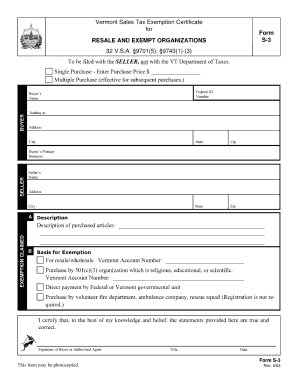

A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the.

. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. This page describes the taxability of. Online PDF Editor Sign Platform Data Collection Form Builder Solution.

Start 30-Day Free Trial. Vermont has state sales tax. Ad Save Time Editing Signing Filling PDF Documents Online.

31 rows Sales Tax Exemptions in Vermont. The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. FOOD FOOD PRODUCTS AND BEVERAGES TAXABLE Food food products and beverages are exempt from Vermont Sales.

Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section 9771 of this title and the use tax imposed under section 9773 of this title. Wednesday March 16 2022 - 1200. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

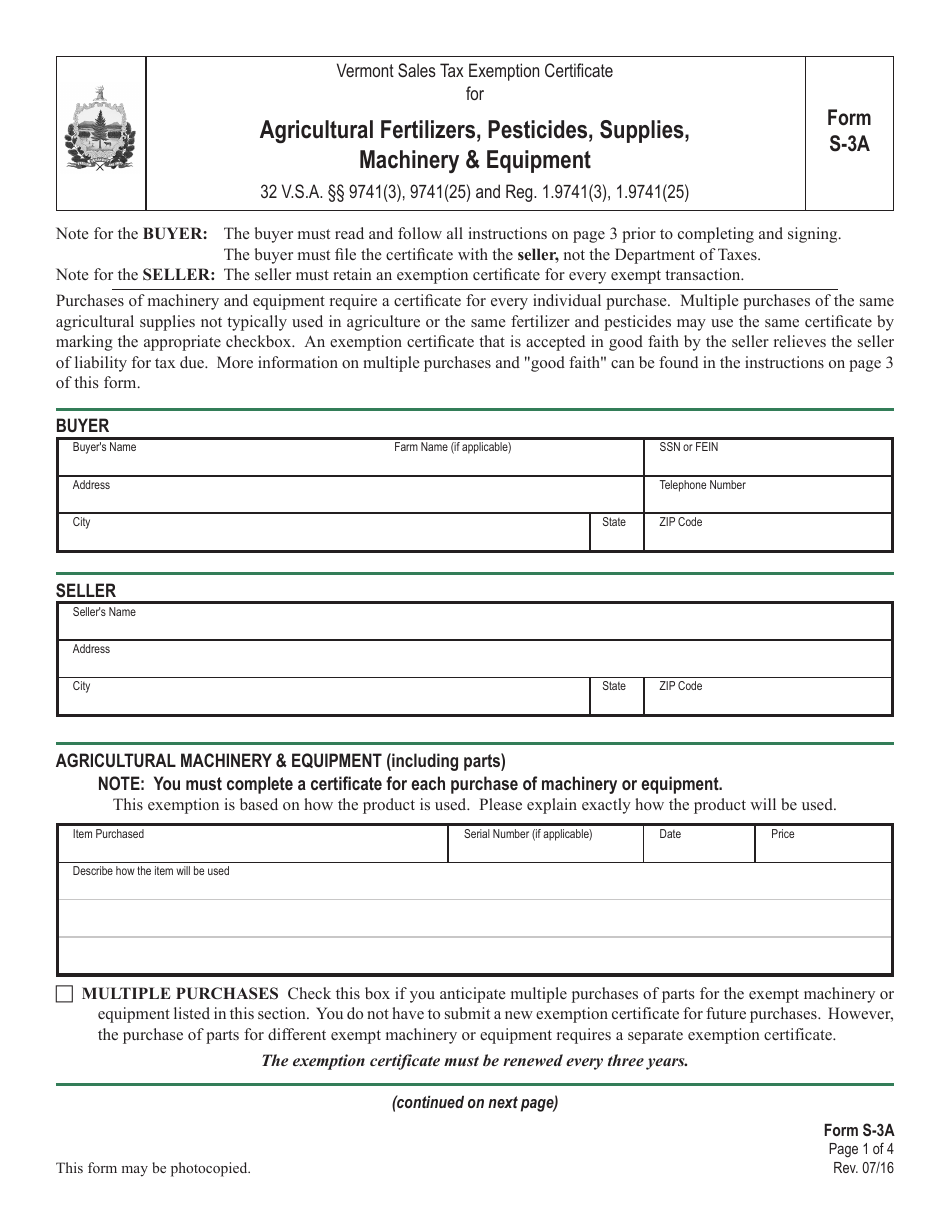

10 rows Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Machinery. The Vermont Sales Tax Exempt Certificate For Manufacturing Publishing Research Development or Packaging is utilized when purchasing items used in the operation of the. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000.

What is Exempt From Sales Tax In Vermont. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

Cents 67 of the receipts from such sales are also exempt from tax. Lowest sales tax 6 Highest sales tax 7 Vermont Sales Tax. In Vermont certain items may be exempt from the.

Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA. Sales Use Tax Exemptions by State Present state sales tax exemption certificates to vendors hotels restaurants and other service providers in Vermont and various other states to. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit.

The exemption reduces the appraised value of the home. Local jurisdictions can impose. 63592 and 63594 ANIMAL LIFE FEED SEEDS PLANTS AND FERTILIZER DRUGS.

Average Sales Tax With Local. Do Vermont sales tax exemptions expire. What is exempt from sales tax in Vermont.

Fillable Online Form S 3 Vermont Sales Tax Exemption Certificate For Purchases For Fax Email Print Pdffiller

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

State By State Guide To Taxes On Retirees Retirement Tax States

Fillable Online Vermont Sales Tax Exemption Certificate Fillable Form Fax Email Print Pdffiller

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

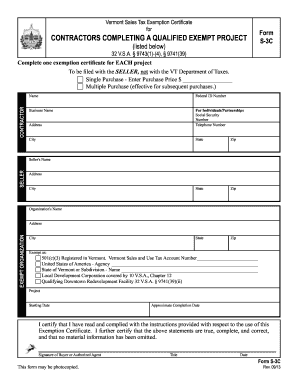

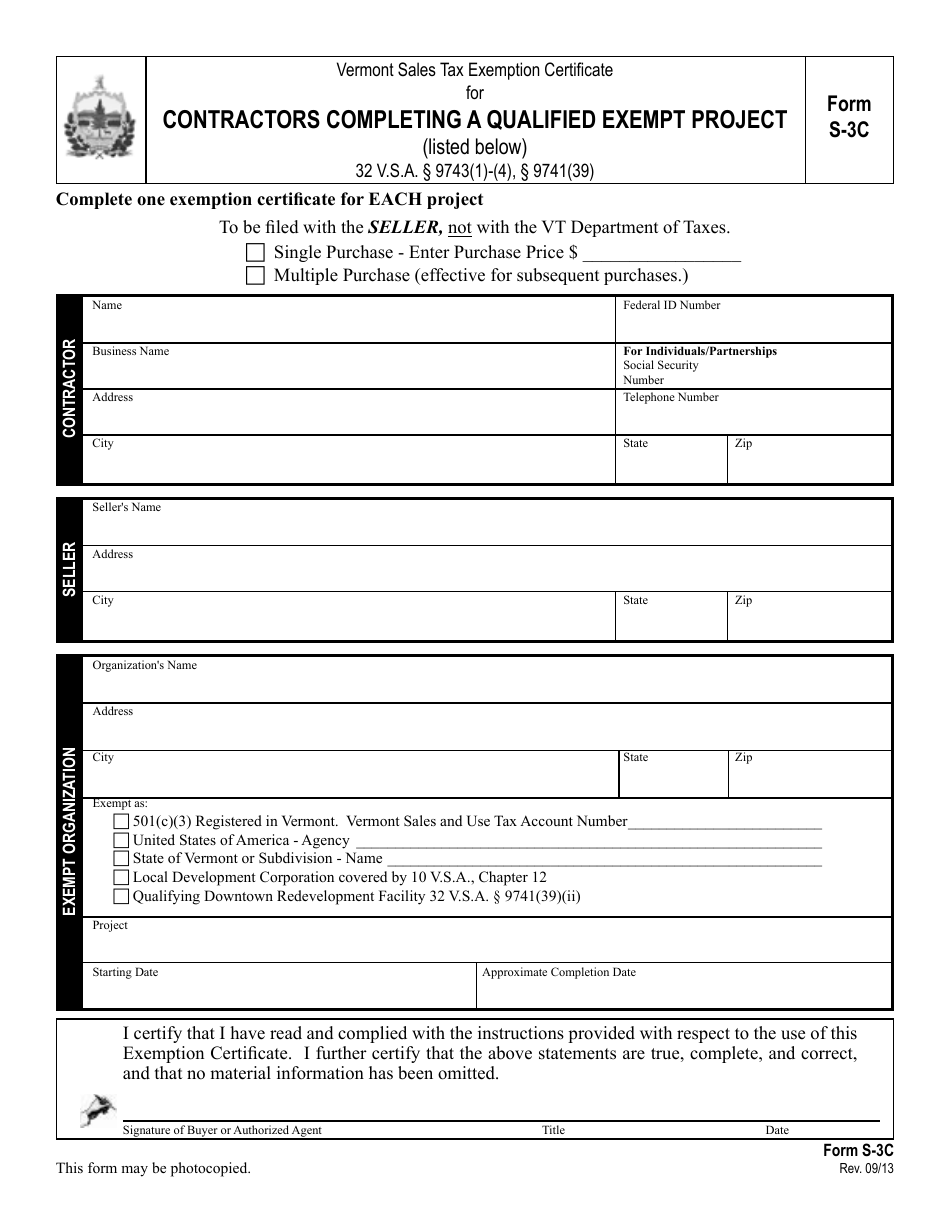

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Form S 3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

Exemptions From The Vermont Sales Tax

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

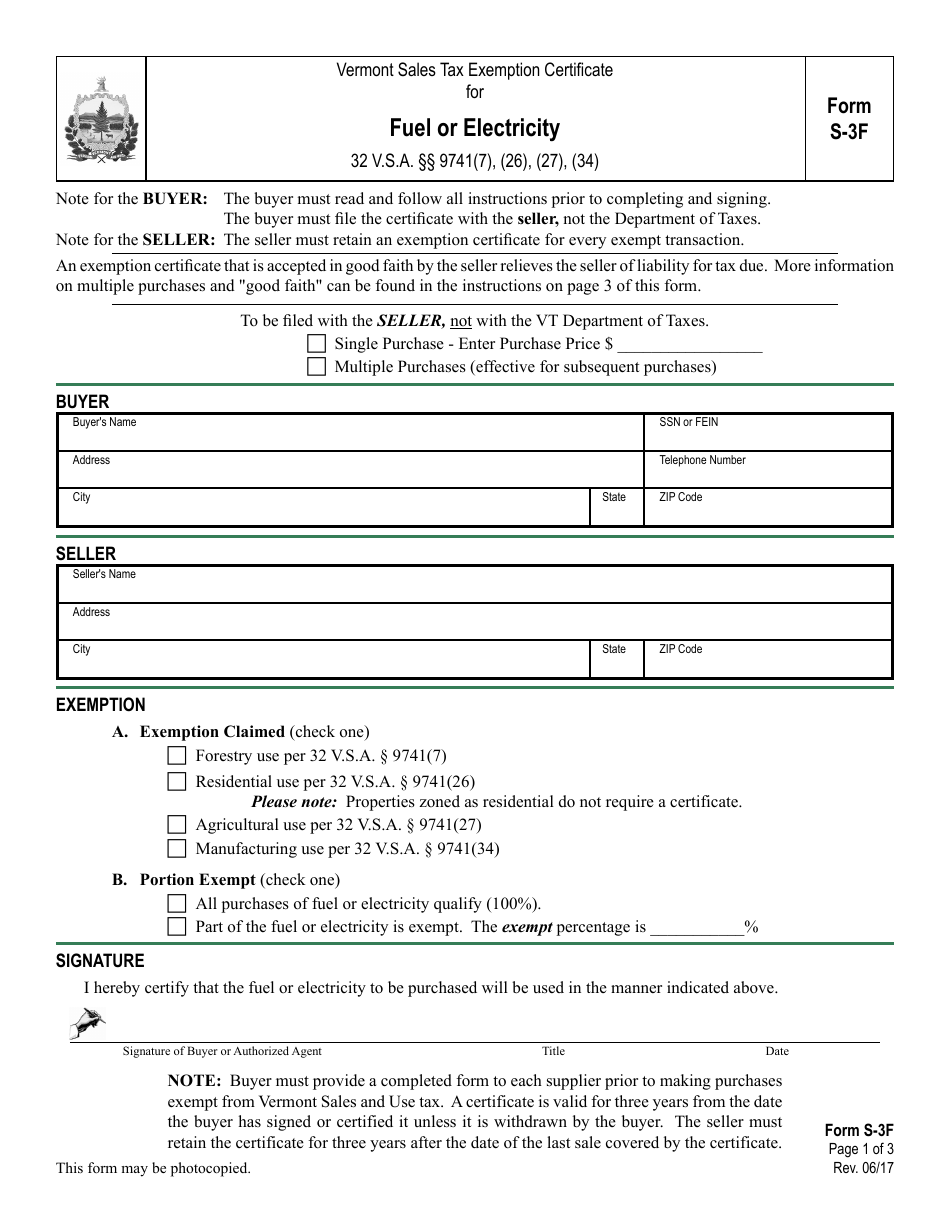

Form S 3f Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Fuel Or Electricity Vermont Templateroller

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm